Tech Talent Flight

America’s 100% tariffs on Chinese EVs, Technological Supremacy, PwC to be fined over Evergrande auditing work.

America’s 100% tariffs on Chinese EVs

By The Economist

Although it is unfashionable to say so these days, one of the great accomplishments of the past half-century was the remarkable decrease in global tariffs. This reduction, from average levies on imports of more than 10% in the 1970s to 3% today, helped fuel a boom in international commerce and a near-tripling in global gdp per person. The more that countries opened up, the more they flourished. So it is deeply regrettable that President Joe Biden has decided to impose tariffs of 100% on electric vehicles (evs) made in China.

Because trade benefits consumers broadly, but harms specific workers and companies that are able to organise resistance, it has always carried political costs. Today those costs loom large in politicians’ minds. The consensus required to underpin an open trading system is disintegrating, a process accelerated by the fact that China is not playing fair, as well as the rise of Donald Trump’s America-first vision.

Politicians in America from both parties argue that they need to increase tariffs on a wide range of goods. China is heavily subsidising its manufacturers, giving them an edge in global markets. And, they add, the security risk of letting in Chinese cars is too great, since evs are easily tracked and monitored. There is something to these concerns. But Mr Biden’s tariffs are a blunt tool for dealing with them and will bring underappreciated economic harms to America and the world.

Return, for a moment, to first principles. As David Ricardo laid out more than two centuries ago and experience has since shown, it makes sense for governments to open their borders to imports even when others throw up barriers. Residents in the liberalising country enjoy lower prices and greater variety, while companies focus on what they are best at producing. By contrast, tariffs coddle inefficient firms and harm consumers.

America learned this the hard way in the 1980s, when Japanese carmakers—in Washington’s crosshairs—agreed to quotas, driving up their prices in America. And for what? The “big three” carmakers continued to churn out clunkers. Today’s American firms fear competition from byd’s Seagull, some versions of which cost less than $10,000 in China. Now, they can sell inferior cars for three times the price. This gives American motorists little incentive to switch to greener wheels, as Mr Biden says he wants them to. You might argue that tariffs were inevitable, because America’s green subsidies would otherwise flow to Chinese firms. That is true, but it shows how one inefficient policy leads to the next.

Even less excusable is how the Biden administration went about imposing its tariffs. Governments are rightly keen to manage the political costs of trade. That is why the rules-based trading system has mechanisms against unfair competition. Although economists welcome cheap imports, politicians can fight back if they worry that an influx would hurt specific industries and towns. Since the second world war, America has generally used the power of example to establish the trade-off between economic efficiency and political reality.

No longer. The latest tariffs reject such mechanisms. The administration could have set out how Chinese evs had gained from huge subsidies and then hit them with calibrated countervailing duties. It could have documented the security threat it claims they pose, rather than offering scary conjectures. Instead, it covered its protectionist aims with a fig-leaf: the new tariffs were put on top of Mr Trump’s, which were themselves originally justified by China’s theft of American technology. How farcical. The real fear about Chinese evs today is not that they are stealing from America, but that they have left American cars in the dust.

America’s blatant disdain for the need to make a rigorous case has dangerous consequences. At home it invites more firms to seek protection. Republicans and Democrats are already vying to offer the steepest barriers: Mr Trump has warned that he will put tariffs of 200% on cars made by Chinese-owned plants in Mexico. Abroad, protectionists will follow suit as China exports its surplus around the world, dealing another blow to the trading system that America once championed. Brazil is increasing tariffs on evs and the European Union may soon do so, too. America is still leading global trade policy—but in the wrong direction.

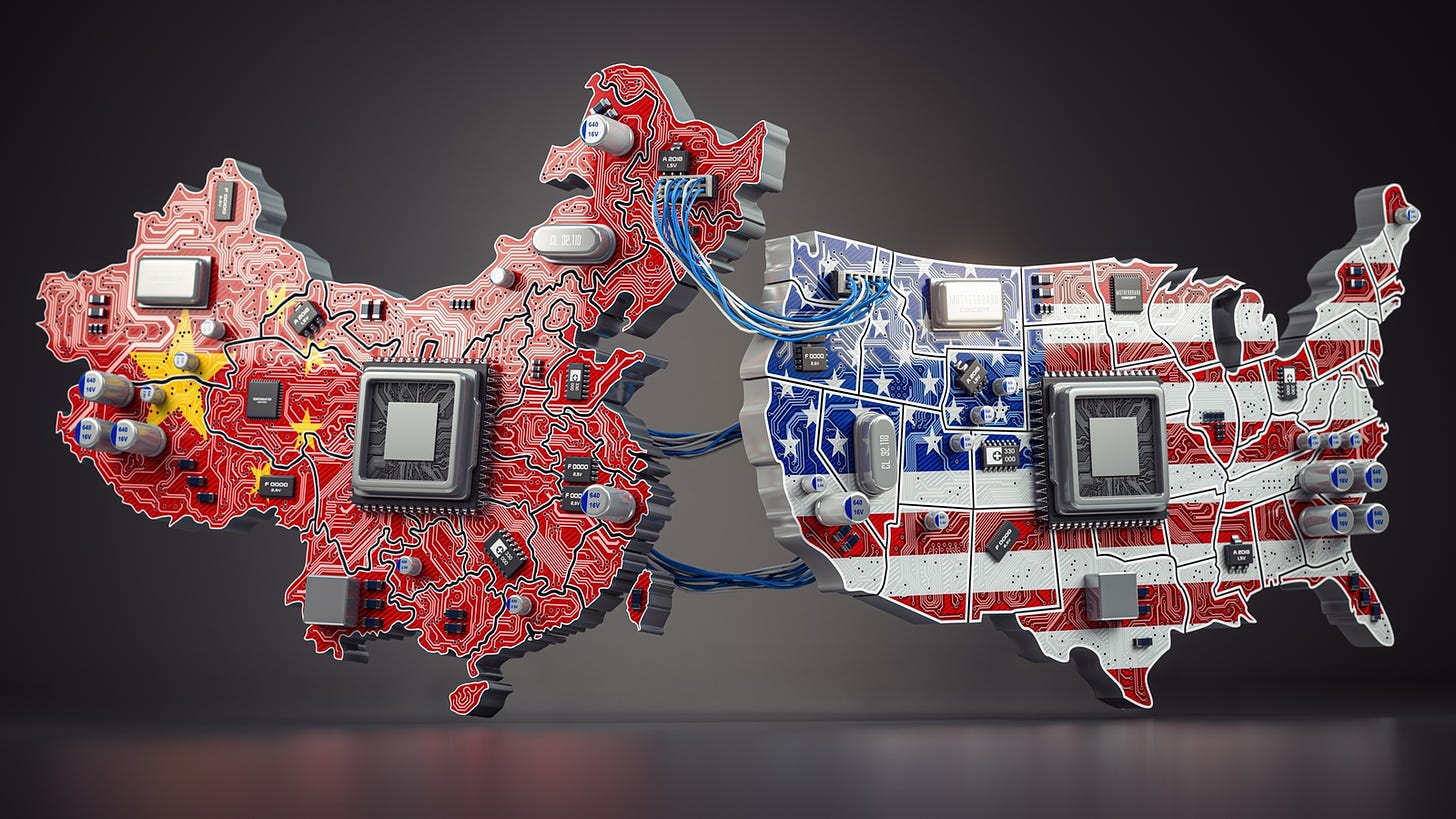

Technological Supremacy

By Jowi Morales (Tom’s Hardware)

Microsoft is asking nearly 10% of its China-based workforce to move to the U.S., Ireland, Australia, or New Zealand. According to Reuters, most affected workers are Chinese engineers working in the company’s machine learning and cloud computing divisions — key battlegrounds that the U.S. and China are vying for in their bid to gain technological supremacy.

This announcement came soon after the White House’s press release announcing increased tariffs on high-tech Chinese goods and can be seen as Microsoft’s reaction to keep the U.S. government happy. However, a Microsoft spokesperson said in an emailed statement to Reuters that this was just a routine business move.

“Providing internal opportunities is a regular part of managing our global business. As part of this process, we shared an optional internal transfer opportunity with a subset of employees,” Microsoft said in its email. The spokesperson also added that “Microsoft remains committed to China and will continue to operate there and other markets.”

Although the company did not confirm how many employees received the transfer opportunity, internal sources say it affects 700 to 800 people. This is a substantial number of Microsoft’s China-based workforce. The Global Times reported in 2022 that Microsoft already had more than 9,000 full-time workers and was expected to hire over a thousand more in the following year.

There is no telling how many offers will be accepted, especially as this is optional for the employees. But even if a small number only accepts Microsoft’s proposal, this is a potential brain drain of China’s top talent, especially given their highly niche specialties. After all, many former Microsoft employees eventually became leaders in top Chinese tech firms, including Baidu and TikTok-owner ByteDance.

Microsoft’s heavy presence in China has invited scrutiny from American lawmakers. In a March 2024 letter to U.S. Commerce Secretary Gina Raimondo, U.S. Representative Pat Fallon said, “What we seek to understand is if and how Microsoft’s broad usage across the U.S. federal government, close ties to [the People’s Republic of China]’s government and compliance with intrusive PRC laws threatens U.S. national and economic security.”

He then adds, “No U.S. company should be playing a role in supporting the Chinese government. It is critical that any such efforts be stopped, and that broader Chinese operations be carefully scrutinized.”

We cannot confirm whether the transfer offer is indeed a routine business decision or a move designed to keep American pressure off Microsoft’s China operations. However, with the emails coming so soon after the White House’s recent moves to up the ante in the Sino-American chip war, we cannot help but feel that Microsoft is taking steps to slowly move away from China and avoid U.S. sanctions.

PwC to be fined over Evergrande auditing work

By Jeff Pao (Asia Times)

PricewaterhouseCoopers (PwC), one of the four largest global accounting firms, is expected to face a fine of at least 1 billion yuan (US$138 million) in China as it stands accused of overlooking misconduct by the collapsed China Evergrande Group for more than a decade.

The auditor will also have some of its local operations in China suspended, Bloomberg reported on Thursday, citing people familiar with the situation.

China’s Ministry of Finance may announce the penalties on PwC as soon as this week, according to the report. The main responsibility of auditors is to check whether the financial statements of their clients contain false and inaccurate statements, in order to protect their clients’ stock and bond investors.

Since auditors receive audit fees from their clients, they may tempted to skip following the standard code of rules and turn a blind eye to their client’s misstatements. This is why the accounting sector has set up rules for auditors to follow.

If a financial statement provides accurate figures, an auditor can give a standard unqualified opinion, or “clean opinion,” so investors can trust it. If a financial statement contains material misstatements or omissions, an auditor should give a qualified opinion and alert the investors. In an extreme case, an auditor should quit auditing a problematic financial statement.

‘Clean opinions’

PwC had served as Evergrande’s auditor for 14 years between 2009 and 2023. Throughout the years, it had given standard unqualified opinions to Evergrande’s financial statements, meaning that it was stating its belief that each statement gave a true and fair view and complied in all material respects with the relevant financial reporting framework, including applicable law.

Before Evergrande’s defaults were reported by the media in August 2021, PwC still gave “clean opinions” to the company’s 2020 financial report.

PwC received an audit fee of 54 million yuan from Evergrande in 2020, according to a Guangdong-based columnist using the pen name “Red-blue-white Tulips,” who published an article on February 22.

He says that PwC had received audit fees of about 400 million yuan from Evergrande and its subsidiaries between 2009 and 2023.

PwC failed to do the auditing work for Evergrande’s 2021 and 2022 financial statements. It blamed the property developing for not providing it with the information needed.

It resigned from its position as Evergrande’s auditor in January 2023. Last July, Evergrande published its delayed annual results for 2021 and 2022, which were audited by Prism Hong Kong and Shanghai Limited.

Evergrande said it lost a combined 803 billion yuan in 2021 and 2022. At the end of 2022, it had net current liabilities of 687.7 billion yuan and total liabilities of 2.44 trillion yuan.

Evergrande’s fraud

On March 18, the China Securities Regulatory Commission (CSRC) slapped fines worth 4.18 billion yuan and 47 million yuan on Evergrande and its founder Hui Ka-yan, respectively.

It said the company’s annual reports in 2019 and 2020 contained false information. It said it’s a fraud that Evergrande used these annual reports to issue bonds and raise fund. Since then, many Chinese commentators have predicted that PwC would be probed and fined for having failed to identify the problems in Evergrande’s financial statements.

In early April, an open letter written by “some PwC partners” with the title “Who brought PwC into the fire pit of Evergrande?” was widely circulated on social media. The letter said Raymund Chao, Asia Pacific and China Chairman, PwC China, and his team should be held responsible for overlooking the problems in Evergrande’s financial statements.

It said some senior PwC executives had suggested that the auditing firm stop serving Evergrande in 2014 but Chao insisted on keeping it as client.

On April 16, PwC said in a statement that the open letter made false allegations and hurt the accounting firm’s reputation. It said it had reported the case to the law enforcement department and would reserve the right to pursue legal liability against those who fabricate, spread and disseminate false information.

On April 19, Hong Kong’s Accounting and Financial Reporting Council (AFRC) said it had initiated an investigation after the open letter, or so-called whistle-blower report, expressed significant concerns regarding potential alleged deficiencies in PwC’s systems of quality management and the quality of the audits of Evergrande.

Read more here.