SWIFT transition to BRICS+ pay

West ‘increasingly worried’ over BRICS+, BRICS+ Future Currency, BRICS+ blockchain payment system

West ‘increasingly worried’ over BRICS+

By Dennis Small

“We are interested in enhancing the role of the BRICS states in the currency, financial and trade systems, developing interbank cooperation, expanding the use of their national currencies in mutual trade and pooling efforts in creating a rating agency and the association’s exchange,” Lavrov stated. He emphasized that not everyone is happy with these BRICS initiatives: “This work is becoming an increasing concern for the U.S. and its allies. They understand that in case of success—and we will achieve success—it will call into doubt the mechanisms of globalization of which the West is in charge now.… The West has started to shamelessly abuse these mechanisms, using them for suppressing competitors and punishing those who do not accept its neocolonial policy.”

Lavrov’s emphasis on the BRICS as a replacement for the collapsing Western financial system served to underscore the spot-on analysis presented the same day by the Chairman of the State Duma Vyacheslav Volodin on his Telegram channel. Volodin argued that the blowout of the U.S. debt bubble was the immediate cause of all of the West’s wars of aggression around the world. “To maintain its hegemony, they started a war in Ukraine and sacrificed the economy of the European Union. But that is not enough. Today they are again provoking military escalation, now in the Middle East. Washington will continue to create more and more military conflicts, trying to delay the default.”

Lavrov reported that Russia’s 2024 chairmanship of the BRICS would focus on three main areas: “politics and security, the economy and finance, and cultural and humanitarian contacts. In light of the accession of five new members to our association on January 1, the key priority now is to ensure the new members’ harmonious integration into the strategic partnership architecture and to preserve the effective operation of all existing BRICS mechanisms.” BRICS will also deepen dialogue with “friendly countries in the BRICS Plus/BRICS Outreach format” and with the EAEU, CIS, CSTO and the SCO.

Read more here.

BRICS+ Future Currency

Alexander Babakov, vice-president of the State Duma, stated on Thursday, March 6th, that the BRICS (Brazil, Russia, India, China and South Africa) alliance is working on creating its own currency and will submit proposals at the organisation's upcoming summit in August in South Africa.

The declaration was not only the culmination of cooperation efforts between the fifth emerging economies to preserve their position in the global system after Western powers worked since the 1990s to prevent them from assuming their positions in international economic organisations — especially the World Bank and the International Monetary Fund. However, it also raised many questions about the impact of the new currency on the global financial system, particularly given the strength of the five economies in the international arena and the alliance's stated intention to expand to include additional developing nations such as Saudi Arabia, Iran, Egypt, and Bangladesh.

This paper tries to predict the consequences of creating the new currency on the structure of the global financial system and its impact on other major currencies, considering the European Union's experience in creating the Euro.

Analysis

This analysis will be divided into two major sections. The first will examine the impact of creating a new currency from an alliance of several strong economies on the global financial system. No other experience can be measured in the modern era except for the European Union’s experience in issuing the Euro.

While the second section seeks to assess the strength and weaknesses of introducing a new currency, considering the economic capacity of the five countries and the countries that are anticipated to join them.

The Euro Experience

The Euro is the official currency of 20 of the 27 member states of the European Union (EU). This group of states is known as the eurozone or, officially, the euro area and includes about 344 million citizens as of 2023.

The Euro is the second-largest reserve currency and the second-most traded currency in the world after the United States dollar. Moreover, as of December 2019, with more than €1.3 trillion in circulation, the Euro has one of the highest combined values of banknotes and coins in circulation worldwide.

The Euro was introduced to world financial markets as an accounting currency on January 1st, 1999, and by March 2002, it had completely replaced the former currencies. Between December 1999 and December 2002, the Euro traded below the US dollar but has since traded near parity with or above the US dollar, peaking at US$1.60 on July 18th, 2008, and returning near its original issue rate. On July 13th, 2022, the two currencies hit parity for the first time in nearly two decades due in part to the 2022 Russian invasion of Ukraine.

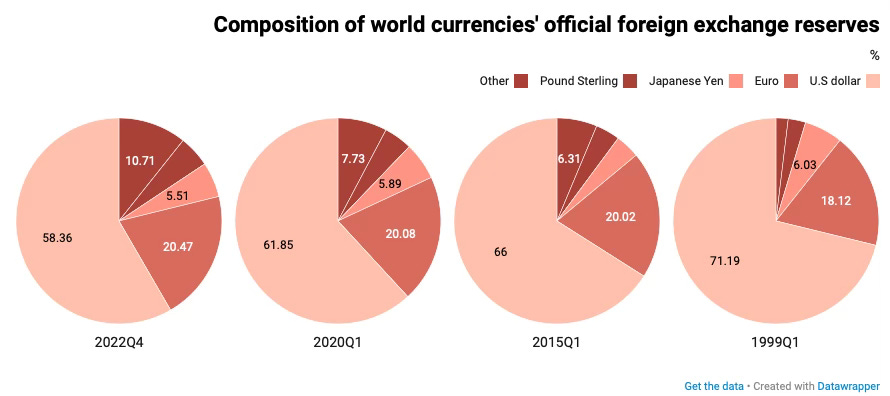

Since the Euro submitted to the financial markets in the year 2000, it has taken a pioneering place among international currencies, especially as a cash reserve currency to replace the pound sterling and Japanese yen as the second largest currency, as shown in the following figure:

Composition of world currencies' official foreign exchange reserves

The percentage of the Euro has increased from 18.12% at the end of the first quarter in 1999 to 20.47 % at the end of the fourth quarter in 2022. With the introduction of the Euro, dollar-denominated cash reserves began to decline, but this was not attributable to the Euro itself but rather to the growing significance of other currencies, such as the Chinese yuan. For over two decades, the Euro’s share of the world’s total monetary reserves has not exceeded 2 per cent. It should also be noted that the 18% that the Euro dominated at the beginning of its launch is the same percentage that the currencies of European countries formed in global reserves before its launch, especially the French franc and the German mark.

When we re-examine the evolution of these international reserves of other currencies, we see that the dollar reserves continue to grow over time and that it will remain the leading currency for the foreseeable future. This also applies to the Euro, with the yen, pound, and yuan experiencing quicker growth, as shown in the following figure:

Total Foreign Exchange Reserves

Finally, the graph illustrates a clear global trend to diversify the monetary reserves of the world’s countries, as opposed to relying solely on the Euro and the dollar during the nineties, to attain greater monetary independence and lessen exposure to these two currencies.

To summarise this part, it became clear that with the creation of the Euro, it replaced the reserves of the countries that formed it. As a result, the Euro began to grow as the second largest reserve after the US dollar without diminishing the dollar’s dominance over monetary reserves over more than 20 years since its adoption, while the percentage of dollar dominance decreased because of the rise of other currencies, especially the yen, the pound sterling and the renminbi.

The percentage of the Euro has increased from 18.12% at the end of the first quarter in 1999 to 20.47 % at the end of the fourth quarter in 2022. With the introduction of the Euro, dollar-denominated cash reserves began to decline, but this was not attributable to the Euro itself but rather to the growing significance of other currencies, such as the Chinese yuan. For over two decades, the Euro’s share of the world’s total monetary reserves has not exceeded 2 per cent. It should also be noted that the 18% that the Euro dominated at the beginning of its launch is the same percentage that the currencies of European countries formed in global reserves before its launch, especially the French franc and the German mark.

When we re-examine the evolution of these international reserves of other currencies, we see that the dollar reserves continue to grow over time and that it will remain the leading currency for the foreseeable future. This also applies to the Euro, with the yen, pound, and yuan experiencing quicker growth, as shown in the following figure:

Total Foreign Exchange Reserves

Finally, the graph illustrates a clear global trend to diversify the monetary reserves of the world’s countries, as opposed to relying solely on the Euro and the dollar during the nineties, to attain greater monetary independence and lessen exposure to these two currencies.

To summarise this part, it became clear that with the creation of the Euro, it replaced the reserves of the countries that formed it. As a result, the Euro began to grow as the second largest reserve after the US dollar without diminishing the dollar’s dominance over monetary reserves over more than 20 years since its adoption, while the percentage of dollar dominance decreased because of the rise of other currencies, especially the yen, the pound sterling and the renminbi.

The Impact of a BRICS Currency

The strength of the new BRICS currency derives from two fundamental factors: first, the strength of the five countries that form the group, as well as the countries which are expected to join, and second, the turbulent global economic environment in which the currency is introduced.

The BRICS Strength:

The BRICS countries represent about 42% of the world’s population, 27% of the global GDP, and over 18% of the world’s trade. One of the critical strengths of BRICS is their significant economic potential. The five countries are among the fastest-growing emerging economies in the world and have collectively contributed to nearly 50% of global economic growth in recent years. In addition, the BRICS countries have several economic strengths that have contributed to their rapid growth in recent years:

1. Large and growing domestic markets: All the BRICS countries have large populations with growing middle classes, which provides a strong base for domestic consumption and investment.

2. Abundant natural resources: BRICS countries have vast reserves of natural resources such as oil, gas, coal, minerals, and metals, which provide opportunities for export and domestic development.

3. Competitive labour costs: BRICS countries have lower labour costs compared to developed countries, which has attracted foreign investment and helped to drive export-oriented manufacturing.

4. Robust infrastructure: The five countries have been investing heavily in infrastructure such as roads, railways, airports, and ports, which have helped to improve connectivity and reduce transportation costs.

5. Increasing technological capabilities: the group has made significant investments in research and development and is increasingly becoming a centre for innovation and technology.

6. Diversified economies: While each of the BRICS countries has unique economic strengths and challenges, their economies are diverse and not overly reliant on any one sector or product, which helps to reduce vulnerability to external shocks.

BRICS foreign trade:

Among these numerous capacities, the group’s foreign trade comes on top, where the rates of intercession exports between the countries of the group have multiplied over the past ten years. For example, in 2013, the value of exports between the group’s countries amounted to approximately $ 300 billion; in 2018, the value of exports between the group’s countries was $ 555 billion, as shown in the following graph:

BRICS Foreign Trade

The group’s exports to the world also grew from 3.4 billion dollars to 4.1 billion dollars in the same period, to form about one-fifth of the total global trade, with higher growth rates than the globe’s, which rose from 18.8 billion dollars to 22.1 billion levels.

Energy market domination:

The group includes two of the world’s largest energy importers, India, and China, which rank first and third on the list of importers and accounted for more than one-fifth of the total global imports in 2021, or over $ 564 billion of the total $ 2.6 trillion. On the other hand, the group includes Russia, which is the fourth largest oil exporter in the world after the United States, the United Arab Emirates, and Saudi Arabia; if Saudi Arabia joins as planned, the group will also include two of the largest exporters, which will give the group significant market control, as shown the following table:

Biggest Oil Importers and Exporters

Using the New Currency in the Bilateral Trade:

If the group adopts the new currency in inter-trade only among themselves, this will give it a powerful impetus, as it will be used in approximately 5 per cent of the total world trade, regardless of any external parties, and it is anticipated that demand for the new currency will increase sharply. This brings us to our next point as a result of current global situations.

The Turbulent Global Economic Environment:

The global economic system is witnessing a period of major turmoil that may completely reshape the global financial system, because of several factors, the most important of which are:

The widespread economic sanctions:

US administrations began using the dollar-backed financial system as an instrument of sanctions during the administration of former President Bill Clinton between 1993 and 2001. They expanded under subsequent administrations, using The Office of Foreign Assets Control (OFAC).

OFAC is affiliated with the US Department of the Treasury, which serves as the heavy arm of the United States in economic sanctions and is imposing active economic sanctions on nearly 30 countries, including China, Russia, and Iran, at the time of writing. Those sanctions depend on the fact that access to the US financial system is generally necessary for settling dollar-denominated transactions, even when the parties are outside the United States.

OFAC relies on the US Clearing House Interbank Payments System (CHIPS) tool. This tool is used to settle all US dollar transactions between banks, even if the related transactions occur outside the US or between non-US persons. As a result, CHIPS acts as a network for initial settlement for immense value domestic and international payments in US dollars. As of 2015, CHIPS settles over 250,000 transactions per day on average, valued at more than $1.5 trillion in both domestic and international transactions.

This tool is used in the Russian-Ukrainian war to prevent the Bank of Russia from accessing the colossal dollar reserves it deposits with several international banks, especially in Europe. The withdrawal of any quantities of these reserves with banks requires settlement in CHIPS. This will result in OFAC denying the bank that carried out the operation access to the US financial system.

The more the US administrations use the sanctions, the more countries are willing to replace the dollar to escape possible sanctions in case of a dispute with the US administration. This led to many countries abandoning their dollar reserves and replacing them with other currencies.

Internationalisation of the Renminbi:

An international currency is used and held beyond the borders of the issuing country, not merely for transactions with that country’s residents but also, and importantly, for transactions between non-residents. This is precisely what China has been doing since the late 2000s.

Chinese efforts to convert the yuan into an international currency, gradually replacing the dollar, began to fruit. By 2020, China had about 40 trade agreements using local currencies with different countries, the most important of which are:

• In 2013, China signed a three-year currency exchange agreement with the European Union worth 350 billion yuan and 45 billion euros for three years, last renewed in 2020.

• China dealt several severe blows to the dollar in 2014 when the Bank of Canada and the People’s Bank of China (PBoC) signed a currency swap agreement to create a three-year C$30 billion/CNR 30 billion and CNY 200 billion currency swap line. This agreement was renewed in 2017 and then finally in January 2021.

• In 2014, China and Russia signed a three-year currency swap deal worth 150 billion yuan ($24.5 billion), extended for three years in 2017 and again in 2020. The agreement allows each country’s central bank to access the other’s currency without trading in the US dollar.

• In March 2020, the eight-member countries of the Shanghai Cooperation Organization (SCO), led by China, Russia, and India, decided to adopt local and national currencies in trade exchange, bilateral investment, and bond issuance instead of the US dollar.

• In September 2022, Russia and China signed a 400 billion US dollar deal to trade natural gas for 30 years in local currencies.

• In March 2023, Brazil and China agreed to abandon the US dollar when paying for trade in goods.

These agreements then raise the yuan’s share of international trade, as it ranked fifth among major currencies in value of international trade in 2022; if the new currency is adopted, it will immediately replace the local Chinese currency in most of these contracts, which will tremendously promote it.

The commodities super-cycle:

The global economy is witnessing one of the worst waves of inflation in its history and the worst ever during the past forty years, which creates a great demand for basic commodities. It raises the incomes of countries exporting them. These developments serve the BRICS group, which considers all its countries to be exporters of raw materials except for China. Hence, the following figure shows an upward trend for commodities:

Commodities Super-cycle

Simultaneously, the high prices of commodities are putting pressure on the economies of developing countries that are heavy consumers of energy and food commodities, which puts severe pressure on their budgets. As a result, they resort to borrowing, considering the high-interest rates on the dollar, which will force many developing countries to use the new currency to purchase the products of the group’s countries to escape the dollar.

Obstacles to the New Currency:

There are two main obstacles in front of the new currency, which are the great dominance of the dollar over the global economy, the low reliability of the currencies of the group countries in confrontation compared to the dollar:

The Dollar Dominance:

The dollar remains the dominant currency in practically every aspect of the current global financial system, with the euro a distant second. It appears doubtful that another currency will soon surpass the dollar or the euro. In order to challenge dollar hegemony, it would be necessary to restructure the international financial system, including the functions of Western-led international financial institutions like the International Monetary Fund and the World Bank; the following graph abstract the dollar dominance:

Dollar domination of international monetary system

Higher Risk Premium:

The market perception of risk, as measured by sovereign credit default swaps, is much greater for BRICS than for reserve-currency issuers, even when Russia’s June 2022 default on its foreign debt is excluded. Therefore, establishing a BRICS currency that acts as a store of value or reserve for central banks of middle-income market nations will continue to be a long-term problem.

Risk premium: BRICS vs currency issuer countries

Concluding Results:

The launch of the new currency will replace the currencies of its issuers in global reserves, making it less than 3% of the total of these reserves.

The new global trade currency shares will rise very quickly compared to the euro at the beginning of its launch due to the highly turbulent global conditions.

Debt requests in the new currency will rise as soon as it is launched due to the super cycle of commodities and the high-interest rate on the dollar, which will prompt many developing countries to request it.

The new currency will not pose a significant challenge to the dominance of the dollar over the global economy except in the long term, to the very long term within 15-20 years.

References

BRICS Currency Could End Dollar Dominance [Internet]. [cited 2023 Jul 19]. Available from: https://foreignpolicy.com/2023/04/24/brics-currency-end-dollar-dominance-united-states-russia-china/

The Euro | European Union [Internet]. [cited 2023 Jul 19]. Available from: https://european-union.europa.eu/institutions-law-budget/euro_en

The international role of the euro, June 2023. [cited 2023 Jul 19]; Available from: https://www.ecb.europa.eu/pub/ire/html/ecb.ire202306~d334007ede.en.html

Euro – history and purpose | European Union [Internet]. [cited 2023 Jul 19]. Available from: https://european-union.europa.eu/institutions-law-budget/euro/history-and-purpose_en

Currency Composition of Official Foreign Exchange Reserve – At a Glance – IMF Data [Internet]. [cited 2023 Jul 19]. Available from:

https://data.imf.org/?sk=e6a5f467-c14b-4aa8-9f6d-5a09ec4e62a4

Trade Map – List of products imported by Brazil, Russia, India, China and South Africa (BRICS) [Internet]. [cited 2023 Jul 19]. Available from: https://www.trademap.org/Product_SelCountry_TS.aspx?nvpm=1%7c%7c6757%7c%7c%7cTOTAL%7c%7c%7c2%7c1%7c1%7c1%7c2%7c1%7c1%7c1%7c%7c1

OFAC Sanctions Lists | Office of Foreign Assets Control [Internet]. [cited 2023 Jul 19]. Available from: https://ofac.treasury.gov/ofac-sanctions-lists

Gao H, Yu Y. Internationalisation of the renminbi. 2009;

It’s All about Networking: The Limits of Renminbi Internationalization [Internet]. [cited 2023 Jul 19]. Available from: https://www.csis.org/analysis/its-all-about-networking-limits-renminbi-internationalization

Hao K, Han L, Li (Tony) Wei. The impact of China’s currency swap lines on bilateral trade. International Review of Economics and Finance. 2022 Sep 1;81:173–83.

Commodity Markets [Internet]. [cited 2023 Jul 19]. Available from: https://www.worldbank.org/en/research/commodity-markets

Read more here.

BRICS+ blockchain payment system

By bne IntelliNews

For a long time, the BRICS countries have been trying to move away from the dollar, but creating a common currency has not been possible, due to the dominance of China's economy within the group, which means any common currency would de facto be the yuan.

However, Kremlin aide Yury Ushakov said in an interview with TASS that a solution has been suggested: instead of a currency, a new blockchain-based payment system will be used called “BRICS Pay”.

"We believe that creating an independent BRICS payment system is an important goal for the future, which would be based on state-of-the-art tools such as digital technologies and blockchain. The main thing is to make sure it is convenient for governments, common people and businesses, as well as cost-effective and free of politics," he said.

Ushakov said the goal for this year is to increase the role of BRICS in the international monetary and financial system. In 2023 the members said in the Johannesburg Declaration would work on increasing settlements in national currencies and strengthening correspondent banking networks to secure international transactions. "Work will continue to develop the Contingent Reserve Arrangement, primarily regarding the use of currencies different from the US dollar," the Kremlin aide pointed out.

Russia has already increased the use of national currencies in its mutual trade with friendly countries to 75% and is due to host this year’s BRICS summit in the Russian region of Kazan this summer.

This is not a new common BRICS currency, but rather an analogue of SWIFT for transactions in national currencies in digital form operating on blockchain technology.

Apparently, this will be integrated with the digital versions of the ruble, yuan, rupee, etc., whose creation is also expected in the very near future.

Russia has accelerated its plans for digital currencies, which operate outside the control of international regulators. The Central Bank of Russia (CBR) has been working to create the long-discussed central bank digital currency (CBDC) – the digital ruble – which is expected to enter into circulation in 2025.

In accordance with new legislation in 2023, the Central Bank of Russia obtains the status of the digital ruble platform's operator. The regulator will also be responsible for the security of digital rubles in circulation, as well as for the organisation and round-the-clock operation of the platform.

The CBDC is not a blockchain-based “coin” similar to those issued by other blockchain-based projects, but an electronic currency, as the CBR controls the emissions of the tokens, which are also under the supervision of the central bank in the same way as fiat currencies are issued and regulated.

The CBR rolled out a pilot of digital ruble in August last year that included several commercial banks, as it gets ready for the formal launch of the digital money. The CBR has also issued a series of guidelines on the digital currency "The Digital Ruble: what it is and how to use it".

"We were preparing a long while for the start of real transactions,” First Deputy Governor of the Bank of Russia Olga Skorobogatova said at a press conference at the time of the start of the pilot. “This pilot will involve, in the first instance, testing of such active transactions as the opening of wallets in digital rubles for banks, clients (individuals and legal entities), transfers of digital rubles between clients and payments in trade and service businesses.”

Read more here.