Plenum and Performance

In a period of systemic change the current transformation is one of systemic decentering, Xi Jinping tells party to show ‘unwavering faith’ in reform plan, China’s Economic Growth Slows.

Enabler not expropriator

For the best part of the past 700 years, the system of global economic expansion has been characterised by increasing integration with more territories incorporated into circuits of capital accumulation against a backdrop of a dominant political-economic hegemon. The world system has expanded as a centre-periphery structure, in which the baton of the hegemon has been handed from the Italians to the Dutch, then to the English and then to the Americans.

In each epoch, the hegemon has expropriated wealth from the periphery. We are now, again, in a period of systemic change. But perhaps, this time, the transformation is not merely one of "passing on the baton" but one of systemic decentering.

The third plenary session of the 20th Central Committee of the Communist Party of China is guided by and will deliberate on the draft of the CPC Central Committee's Decision on Further Comprehensively Deepening Reform and Advancing Chinese Modernization. Much of these deliberations will revolve around core themes such as Chinese modernization, new quality productive forces and high-quality development. All of these have implications not just for China's own development but also for the shape of the world system that is unfolding.

In the past three decades, China has emerged as the world's sole manufacturing superpower. It contributes 30 percent of global value added, and occupies a prime position in all product categories. It has achieved this off the back of strong domestic market growth. In 1995, the ratio of China's manufactured output to exports was 11 percent. This increased to 18 percent in 2004, a few years after the country's admission to the World Trade Organization, receding to 13 percent or so today. Put another way, as output grew so did the domestic market.

At the same time, China has emerged as the largest trading partner for over 140 nations. Over the past decade, China's trade growth with the Global South, particularly those participating in the Belt and Road Initiative, has outstripped trade growth with the mature economies of Europe and the United States. Now, China trades more with the Global South than it does with the US, the European Union and Japan combined.

The current and future phase of export growth will revolve around a combination of renewable energy systems, new energy transport solutions and digital technologies. Intense competition in the domestic market, coupled with rapid automation and cluster-enabled productivity gains, has placed incredible downward pressure on prices. The world market is now the beneficiary of low-cost technologies that overcome development barriers and hasten the decarbonization transition that nations agreed to strive for in the Paris climate accord.

Low-cost and clean transport systems together with energy sovereignty are pivotal to expanded capital accumulation and the decentering of global production and value adding.

China's model is pricing people in by way of abundance. This contrasts with the traditional models of capital accumulation that prices people out through confected scarcity and rent seeking. Consumers are the beneficiaries in the former case, whereas the rentier accumulates wealth in the latter.

China is also emerging as an exporter of capital. Infrastructure investments via the BRI are notable examples, but more recently we are seeing Chinese companies invest in minerals processing and manufacturing facilities in other countries. China isn't just exporting final products; it is exporting value-adding capacity and know-how.

For the best part of the past 30 years, the flow of data globally has been via a network of terrestrial, submarine and stellar infrastructure channeled through data centers in Virginia in the US.Data security and sovereignty were compromised. In effect, as argued recently by US scholars Henry Farrell and Abraham Newman in their 2023 book Underground Empire, the US has weaponized the global economy through its control over the pipes of global commerce

This, too, is changing, as Chinese companies expand an alternative digital network to buttress the growing array of trade infrastructure that has been developed through the BRI. This digital network and its associated infrastructure of data centers is allied with a growing commitment to open-source operating systems and platforms, as the foundation for the new digital standards for the 21st century. Such an approach is enabling an emergent Digital Westphalia.

Chinese modernization is underpinned by what has been called new quality productive forces. These enable the development of low-cost systems of production and circulation, supporting value decentering as infrastructure and know-how are made increasingly available. Just as China seeks to achieve more even development domestically, the effects of its model of global integration via trade, capital exports and transfer of knowhow is also tackling decades of uneven global development.

Overcoming uneven economic development is symbiotic with what Johan Galtung once described as a positive peace. Multipolarity is already a reality today, and the third plenum of the 20th CPC Central Committee is consolidating a policy approach that reinforces the economic underpinnings of a new global economic architecture that can support models of indivisible security for all based on growing economic sovereignty.

To be an expropriator or an enabler? That is the question. In an era of multipolarity, Chinese modernization can only take the form of being an enabler — an enabler of national rejuvenation and of positive peace through decentered, even economic development worldwide. The third plenum consolidates steps toward this.

NB: The author is an adjunct professor at Queensland University of Technology and a senior fellow at the Taihe Institute. The author contributed this article to China Watch, a think tank powered by China Daily.

Read more here.

China’s Third Plenum

Xi Jinping tells party to show ‘unwavering faith’ in reform plan

By South China Morning Post (SCMP)

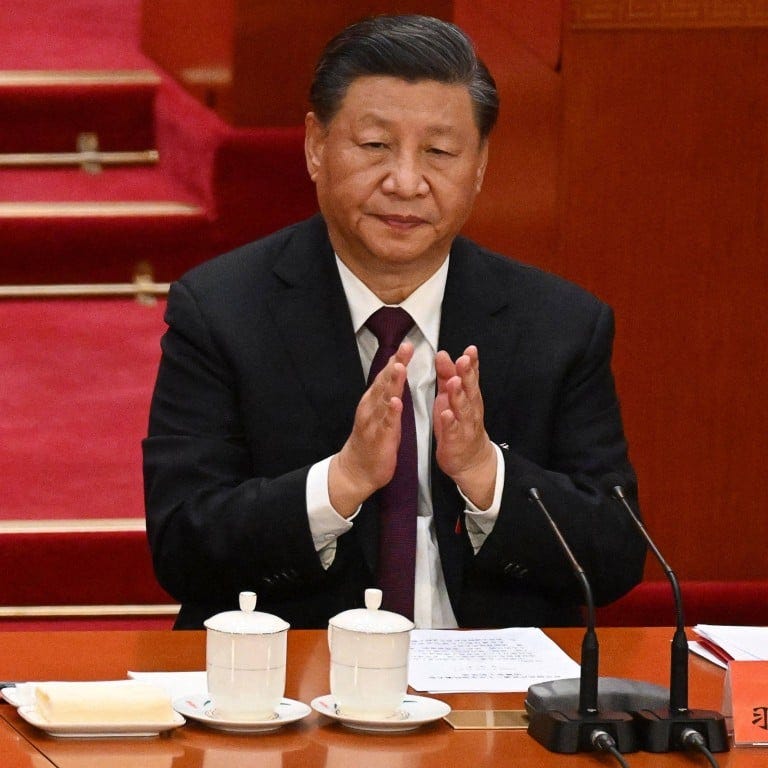

Chinese President Xi Jinping – hailed by official media as a “supreme reformist” – has told the Communist Party to show “unwavering faith and commitment” to his grand strategy even as international investment banks cut their forecast for China’s growth.

The party’s elite Central Committee is currently in the middle of the third plenum, a key policy meeting that will determine the country’s development plan for the next five to 10 years.

The gathering in Beijing is being held against the backdrop of an increasingly complex and challenging environment at home and abroad.

On Tuesday the country released weaker-than-expected growth figures for the year’s first half, prompting some investment banks, including Goldman Sachs, to cut their annual growth forecast for the world’s second-largest economy.

Elsewhere, the prospect of Donald Trump returning to the White House has raised concerns that Washington will adopt a more hawkish policy towards China at a time when the European Union is also stepping up the pressure on Beijing.

As Xi prepared to deliver a work report behind closed doors, the party’s leading theoretical journal Qiushi published a rallying cry by the Chinese leader on Tuesday under the headline “Maintaining Self-Confidence and Self-Reliance”.

China’s third plenum: what to expect from the much-delayed policy meeting

It called on party members to show unwavering faith and commitment to the development path China has charted for itself and warned there is no “ready-made solution” or “foreign instruction manual” it can follow.

The journal also published excerpts from his previous speeches, including a passage that said: “China’s economy did not collapse in the past because of the ‘China collapse theory’, and it will not stop growing because of rhetoric claiming China has plateaued. China’s development prospects are bright, and we have belief and confidence.”

This, together with articles published in other official outlets, including one by state news agency Xinhua that hailed him as a “thoroughbred reformer”, suggests that there will not be any significant directional shift.

Instead, Beijing is likely to stick to its development strategy focusing on technology, advanced manufacturing and other sectors considered critical to the nation’s overall strength.

While this may differ from the typical Western understanding of “reform” – which implies market liberalisation – it is consistent with Xi’s vision, which is about improving the party’s governance and delivering China’s “great rejuvenation”.

Hailing Xi as a “statesman, thinker and strategist”, Xinhua said he had “always shouldered the heavy responsibilities of reform” and “personally reviewed and revised all major plans”.

It also described him as “another outstanding reformer in the country after Deng Xiaoping” and noted that the two paramount leaders “each faced strikingly different historical circumstances”.

Deng had to build up a poverty-stricken China from scratch while Xi had taken over when the country was already the second-biggest economy in the world, but many of the advantages that had helped it develop rapidly – such as cheap labour – were already starting to diminish.

“Instead of resting on the laurels of his predecessors, Xi was committed to carrying on reform, even though he knew how hard it would be,” Xinhua said, adding that he had played a role in all China’s major reforms throughout his career.

Another Xinhua article said Xi had chaired 72 meetings since coming to power in 2013 and been in direct charge of all reform programmes since then.

Xie Maosong, a senior researcher at the National Institute of Strategic Studies at Tsinghua University, said the official messaging clearly signalled that Xi would not be deflected from his chosen path and will institutionalise his brand of reform to ensure it becomes “a major political legacy”.

Deng Yuwen, a former deputy editor of Study Times, the Central Party School’s official newspaper, cautioned that the party must keep an eye on public sentiment as discontent about the weakening economy grew.

“Chinese people today tend to blame unequal opportunities and an unfair system rather than their own lack of ability for their poor economic status, according to a recent survey [by US-based Big Data China],” he said.

“The public wants more upwards mobility, fairer job opportunities and basic things such as food safety. The party must demonstrate that they can deliver these goals.”

Read more here.

China’s Economic Growth Slows

By James Mayger, Lucille Liu, Yujing Liu, Zhu Lin and Jing Zhao (Bloomberg)

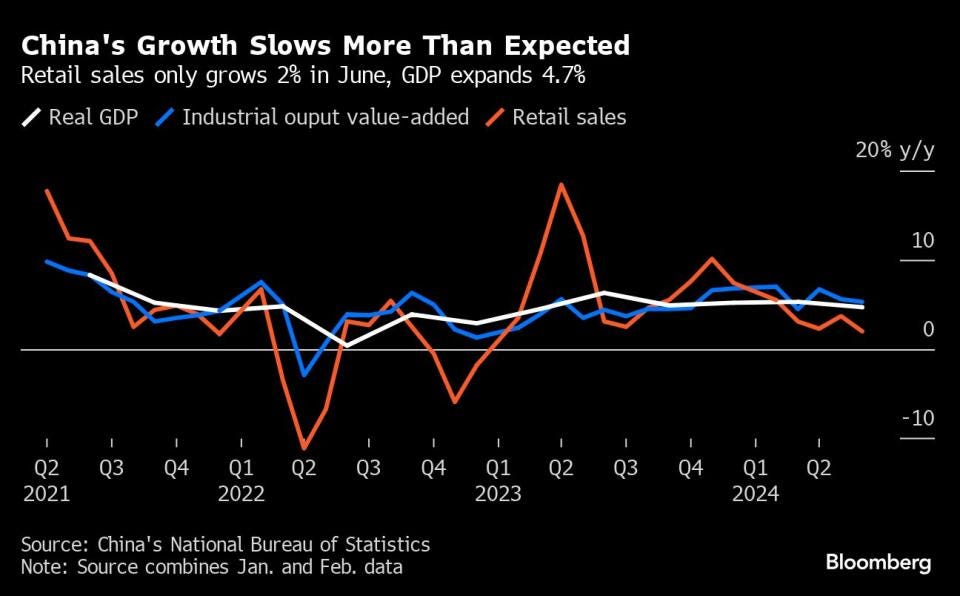

China’s economy grew at the worst pace in five quarters as efforts to boost consumer spending fell short, piling pressure on Beijing to lift confidence at a twice-a-decade policy meeting this week. Gross domestic product expanded 4.7% in the second quarter from the same period a year earlier, undershooting economists’ median forecast of 5.1%. Retail sales rose at the slowest pace since December 2022, showing a flurry of government efforts to juice confidence have done little to reinvigorate the Chinese consumer.

“The government will need to mull greater policy supports to deliver its annual growth target of around 5% after the disappointing second quarter data,” said Xiaojia Zhi, an economist at Credit Agricole CIB in Hong Kong. “The increasing likelihood of Trump 2.0 also means that China will need additional policy efforts to boost its domestic demand in a timely manner, as external demand downside risks loom.”

President Xi Jinping is betting on manufacturing and high-tech sectors to propel China’s growth in the post-pandemic era. That strategy already faces uncertainty as Beijing’s trade partners erect new barriers against Chinese goods, with former President Donald Trump threatening more curbs if reelected. The second quarter data shows policymakers will also need to focus efforts on lifting domestic spending to keep the world’s No. 2 economy on track.

Chinese stocks in Hong Kong extended their declines after the disappointing data, with the Hang Seng China Enterprises Index falling as much as 1.7% before paring some losses. The People’s Bank of China earlier Monday held its benchmark rate steady, amid concerns about capital flight, pressure on bank profits and a need to defend the yuan.

The National Bureau of Statistics said in a statement accompanying the data that the growth slowdown in the second quarter was due to short-term factors such as extreme weather and rain downpours and floods. It also reflected the economy is facing more difficulties and challenges, with the problems of insufficient domestic demand and clogged domestic circulation remaining, the NBS said.

“The root of the growth slowdown is that the property sector as a pillar of the economy is still rapidly shrinking, and home prices are slumping,” said Lu Ting, chief China economist at Nomura Holdings Inc. “To change the fast slowdown in consumption growth China needs to stabilize the property industry, which accounts for about 70% of household wealth.”

What Bloomberg Economics Says ...

China’s 2Q GDP growth undershot even our conservative projection — showing that the economy is struggling to maintain a tepid recovery. A sharp deceleration in consumption and services in June was the main driver – a particularly worrying sign of weak confidence. Industrial production held up slightly better, but also stayed soft in historical terms. This underlines the fact that industrial output won’t be able support a broad recovery alone.

— Chang Shu, Chief Asia Economist

New-home prices in major Chinese cities fell for the 13th straight month in June, adding to evidence that a rescue package unveiled in May has done little to boost sentiment.

The collapse in real estate is hurting consumer confidence. Retail sales rose at the slowest pace since 2022, showing citizens were reluctant to spend despite a government program to subsidize and encourage the replacement of old vehicles and home appliances.

Underscoring that point, China marked its fifth period of deflation in the second quarter, extending the longest slide of economy-wide prices since 1999.

“Amongst all monthly figures released today, the highlight is weak retail sales,” said Raymond Yeung, chief economist for greater China at Australia & New Zealand Banking Group. “Household consumption remains very weak. The ‘replacement’ schemes fail to lift spending. With employers slashing salary and high youth unemployment, households will still be cautious going forward.”

Retail sales of cars fell 6.2% on year in June, the steepest decline in more than a year, as a price war between Chinese automakers left consumers delaying purchases for lower prices. Home appliances and audio-video equipment decreased 7.6% last month, the worst since 2022, and building and decoration materials slid 4.4%.

“The ability and confidence for households to consume still need to be improved,” said Zhang Yi, an NBS official in a separate statement commenting on residents income and spending in the first half. “We should strengthen measures to increase residents’ income.”

The broad slowdown reflected in the figures — the first set of quarterly indicators free of distortions by the pandemic — comes just as Xi began the Third Plenum meeting to set major economic and political policies for the coming years.

In a sign of the conclave’s importance, officials skipped a monthly press conference to answer questions on the data, opting to post the figures online along with a separate statement with comments on the economy. Beijing last disrupted the usual format of a major data release in October 2022, when Xi held a party congress that saw him securing a precedent-defying third term as leader.

Economists have called on this week’s conclave to address the property downturn, boost technology self-sufficiency and relieve local fiscal strains during the four-day gathering. The party’s most senior 24 officials including Xi are set to sit down later this month for a Politburo meeting to discuss specific economic measures.

“While the case for reform is high, it’s unlikely to be a particularly exciting affair,” Harry Murphy Cruise, economist at Moody’s Analytics said of the Third Plenum. “Big policy pivots can be taken as an admission of failure and a sure-fire way to lose face.”

Read more here.