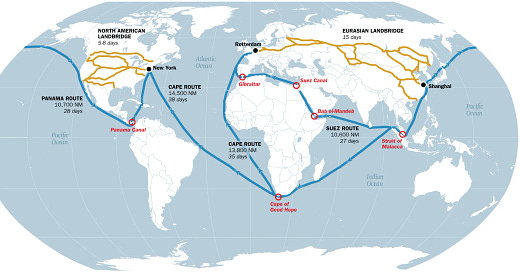

Global Trade Disruptions and Emerging Maritime Routes

Ship attacks in the Red Sea, geopolitical tensions in the Black Sea, and climate change affecting the Panama Canal have disrupted global trade, The Arctic presents a promising alternative

UPDATES: UNCTAD has expressed significant concerns about the escalating disruptions to global trade, citing recent attacks on ships in the Red Sea, geopolitical tensions affecting shipping in the Black Sea, and the impact of climate change on the Panama Canal.

Attacks by Yemen’s Houthi rebels in the Red Sea have severely disrupted international trade alo…