Global Arms Dynamics

European arms imports nearly double, US and French exports rise, and Russian exports fall sharply, Saudi goals of developing an indigenous arms Industry are ambitious.

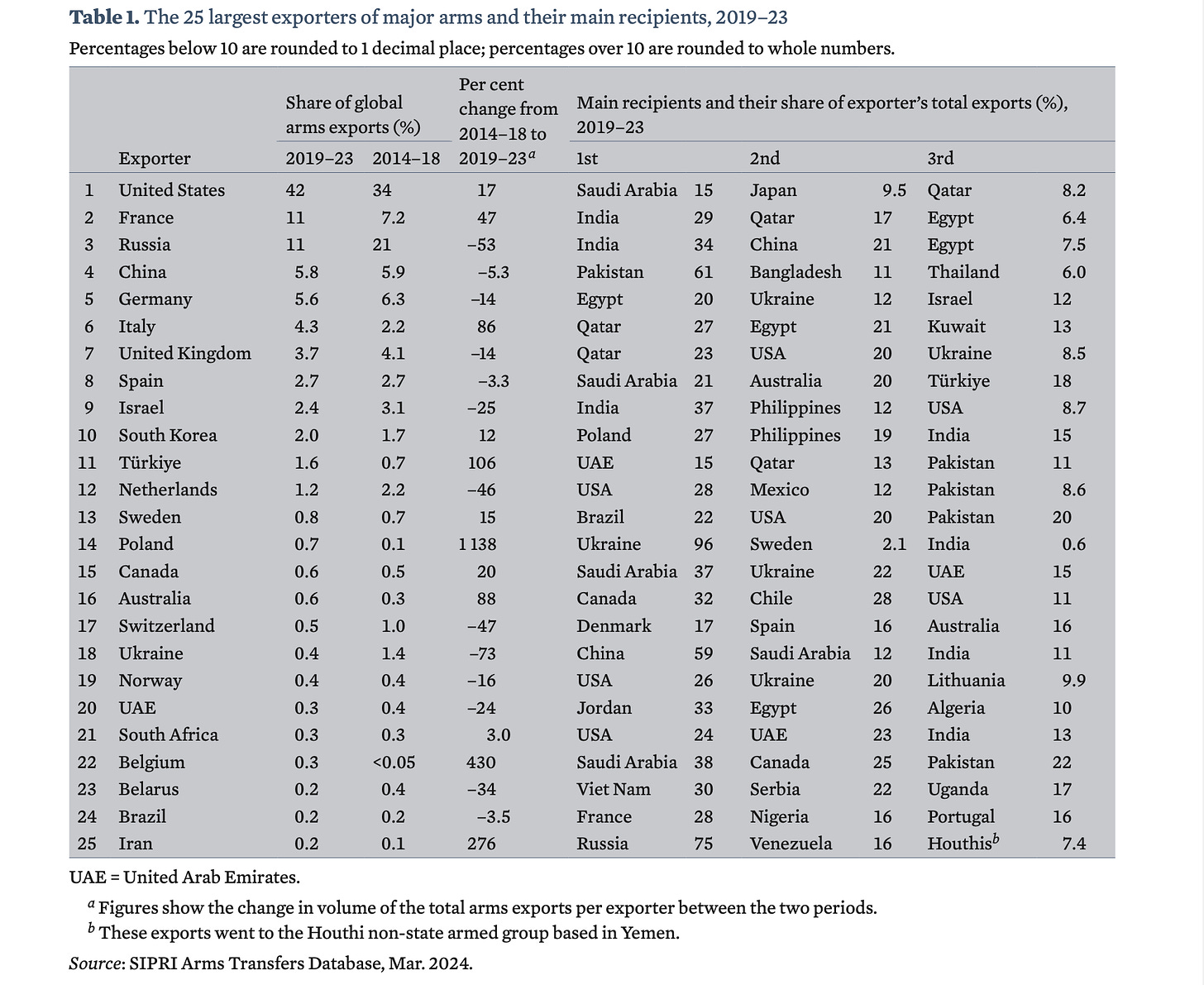

UPDATES: States in Europe almost doubled their imports of major arms (+94 per cent) between 2014–18 and 2019–23. Far larger volumes of arms flowed to Asia and Oceania and the Middle East in 2019–23, where nine of the 10 largest arms importers are. The United States increased its arms exports by 17 per cent between 2014–18 and 2019–23, while Russia’s arms exports halved. Russia was for the first time the third largest arms exporter, falling just behind France. The global volume of international arms transfers fell slightly by 3.3 per cent between 2014–18 and 2019–23, according to new data on international arms transfers published.

The brainchild of Crown Prince Mohammed bin Salman, the de facto ruler of the country, Vision 2030 seeks to reduce Saudi reliance on exporting fossil fuels by diversifying the economy. Saudi Arabia also aspires to rise from its current position as the 19th largest economy in the world to the top 15. One component of the strategy is to develop indigenous manufacturing of weapons. The fifth-largest military spender in the world in 2022, according to the Stockholm International Peace Research Institute, the Saudis were expected to spend nearly $70 billion on arms in 2023. From 2018-2022, Saudi Arabia was the world’s second-largest arms importer, buying 78% of its purchases from the U.S., which accounted for 19% of U.S. arms exports.

Taken from SIPRI

Click here to download the SIPRI Fact Sheet.

Europe’s arms imports up almost 100%

US and French exports rise, and Russian exports fall sharply

By STOCKHOLM INTERNATIONAL PEACE RESEARCH INSTITUTE

Around 55 per cent of arms imports by European states in 2019–23 were supplied by the USA, up from 35 per cent in 2014–18. ‘More than half of arms imports by European states come from the USA,’ noted SIPRI Director Dan Smith, ‘while at the same time, Europe is responsible for about a third of global arms exports, including large volumes going outside the region, reflecting Europe’s strong military–industrial capacity. Many factors shape European NATO states’ decisions to import from the USA, including the goal of maintaining trans-Atlantic relations alongside the more technical, military and cost-related issues. If trans-Atlantic relations change in the coming years, European states’ arms procurement policies may also be modified.’

US and French arms exports climb, while Russian arms exports plummet

The USA’s arms exports grew by 17 per cent between 2014–18 and 2019–23, and its share of total global arms exports rose from 34 per cent to 42 per cent. The USA delivered major arms to 107 states in 2019–23, more than it has in any previous five-year period and far more than any other arms exporter. The USA and states in Western Europe together accounted for 72 per cent of all arms exports in 2019–23, compared with 62 per cent in 2014–18.

‘The USA has increased its global role as an arms supplier—an important aspect of its foreign policy—exporting more arms to more countries than it has ever done in the past,’ said Mathew George, Director of the SIPRI Arms Transfers Programme. ‘This comes at a time when the USA’s economic and geopolitical dominance is being challenged by emerging powers.’

France’s arms exports increased by 47 per cent between 2014–18 and 2019–23 and for the first time it was the second biggest arms exporter, just ahead of Russia. The largest share of France’s arms exports (42 per cent) went to states in Asia and Oceania, and another 34 per cent went to Middle Eastern states. The largest single recipient of French arms exports was India, which accounted for nearly 30 per cent. The increase in French arms exports was largely due to deliveries of combat aircraft to India, Qatar and Egypt.

‘France is using the opportunity of strong global demand to boost its arms industry through exports,’ said Katarina Djokic, researcher at SIPRI. ‘France has been particularly successful in selling its combat aircraft outside Europe.’

Russian arms exports fell by 53 per cent between 2014–18 and 2019–23. The decline has been rapid over the course of the past five years, and while Russia exported major arms to 31 states in 2019, it exported to only 12 in 2023. States in Asia and Oceania received 68 per cent of total Russian arms exports in 2019–23, with India accounting for 34 per cent and China for 21 per cent.

Looking at the other top 10 arms exporters after the USA, France and Russia, two saw increases in exports: Italy (+86 per cent) and South Korea (+12 per cent); while five saw decreases: China (–5.3 per cent), Germany (–14 per cent), the United Kingdom (–14 per cent), Spain (–3.3 per cent) and Israel (–25 per cent).

Steep rise in arms imports to Europe

Arms imports by European states were 94 per cent higher in 2019–23 than in 2014–18. Ukraine emerged as the largest European arms importer in 2019–23 and the fourth largest in the world, after at least 30 states supplied major arms as military aid to Ukraine from February 2022.

The 55 per cent of arms imports by European states that were supplied by the USA in 2019–23 was a substantial increase from 35 per cent in 2014–18. The next largest suppliers to the region were Germany and France, which accounted for 6.4 per cent and 4.6 per cent of imports, respectively.

‘With many high-value arms on order—including nearly 800 combat aircraft and combat helicopters—European arms imports are likely to remain at a high level,’ said Pieter Wezeman, Senior Researcher with the SIPRI Arms Transfers Programme. ‘In the past two years we have also seen much greater demand for air defence systems in Europe, spurred on by Russia’s missile campaign against Ukraine.’

Largest share of arms transfers goes to Asia, with India the world’s top arms importer

Some 37 per cent of transfers of major arms in 2019–23 went to states in Asia and Oceania, the largest share of any region but a slight decrease from 41 per cent in 2014–18. Despite an overall 12 per cent decline in arms imports for the region, imports by several states increased markedly.

For the first time in 25 years, the USA was the largest arms supplier to Asia and Oceania. The USA accounted for 34 per cent of arms imports by states in the region, compared with Russia’s 19 per cent and China’s 13 per cent.

India was the world’s top arms importer. Its arms imports increased by 4.7 per cent between 2014–18 and 2019–23. Although Russia remained India’s main arms supplier (accounting for 36 per cent of its arms imports), this was the first five-year period since 1960–64 when deliveries from Russia (or the Soviet Union prior to 1991) made up less than half of India’s arms imports. Pakistan also significantly increased its arms imports (+43 per cent). Pakistan was the fifth largest arms importer in 2019–23 and China became even more dominant as its main supplier, providing 82 per cent of its arms imports.

Arms imports by two of China’s East Asian neighbours increased, Japan’s by 155 per cent and South Korea’s by 6.5 per cent. China’s own arms imports shrank by 44 per cent, mainly as a result of substituting imported arms—most of which came from Russia—with locally produced systems.

‘There is little doubt that the sustained high levels of arms imports by Japan and other US allies and partners in Asia and Oceania are largely driven by one key factor: concern over China’s ambitions,’ said Siemon Wezeman, Senior Researcher with the SIPRI Arms Transfers Programme. ‘The USA, which shares their perception of a Chinese threat, is a growing supplier to the region.’

Middle East imports high volumes of arms, mainly from the USA and Europe

Thirty per cent of international arms transfers went to the Middle East in 2019–23. Three Middle Eastern states were among the top 10 importers in 2019–23: Saudi Arabia, Qatar and Egypt.

Saudi Arabia was the world’s second largest arms importer in 2019–23, receiving 8.4 per cent of global arms imports in the period. Saudi Arabian arms imports fell by 28 per cent in 2019–23, but this was from a record level in 2014–18. Qatar increased its arms imports almost fourfold (+396 per cent) between 2014–18 and 2019–23, making it the world’s third biggest arms importer in 2019–23.

The majority of arms imports by Middle Eastern states were supplied by the USA (52 per cent), followed by France (12 per cent), Italy (10 per cent) and Germany (7.1 per cent).

‘Despite an overall drop in arms imports to the Middle East, they remain high in some states, driven largely by regional conflicts and tensions,’ said Zain Hussain, researcher at SIPRI. ‘Major arms imported in the past 10 years have been used widely in conflicts in the region, including in Gaza, Lebanon and Yemen. Some states in the Gulf region have imported large volumes of arms to use against the Houthis in Yemen and to counter Iranian influence.’

Other notable developments:

Imports of major arms by states in Africa fell by 52 per cent between 2014–18 and 2019–23. This was mainly due to large decreases for two North African importers: Algeria (–77 per cent) and Morocco (–46 per cent).

Arms imports by states in sub-Saharan Africa decreased by 9.0 per cent. China, which accounted for 19 per cent of deliveries to sub-Saharan Africa, overtook Russia as the region’s main supplier of major arms.

Egypt was the world’s seventh largest arms importer in 2019–23. Its imports included more than 20 combat aircraft and a total of 10 major warships aimed at increasing its military reach.

Australia was the world’s eighth largest arms importer. Its arms imports decreased by 21 per cent. However, in 2023 it reached an agreement with the UK and the USA on importing at least six nuclear-powered submarines.

The USA accounted for 69 per cent and Germany for 30 per cent of arms imports by Israel.

Combat aircraft are the main long-range strike weapon but interest in long-range missiles is increasing. In 2019–23 six states ordered or preselected missiles with a range over 1000 kilometres, all from the USA.

Arms imports by states in the Americas decreased by 7.2 per cent. The USA was the largest importer in the region, followed by Brazil and Canada.

NB: SIPRI data reflects the volume of deliveries of arms, not their financial value.

Read more here.

Saudi Goals of Developing an Indigenous Arms Industry are Ambitious

By Robert Czulda (Stimson Center)

The World Defense Show is an international defense industry exhibition, organized for the second time by Saudi Arabia from Feb. 8-12, 2024. The event — intended to confirm the growing capabilities of the Saudi defense industry – did not entirely achieve its goals. But Riyadh undoubtedly has the potential to at least partially fulfill one aim of its Vision 2030 strategy by reducing dependence on arms imports.

The brainchild of Crown Prince Mohammed bin Salman, the de facto ruler of the country, Vision 2030 seeks to reduce Saudi reliance on exporting fossil fuels by diversifying the economy. Saudi Arabia also aspires to rise from its current position as the 19th largest economy in the world to the top 15.

One component of the strategy is to develop indigenous manufacturing of weapons. The fifth-largest military spender in the world in 2022, according to the Stockholm International Peace Research Institute, the Saudis were expected to spend nearly $70 billion on arms in 2023. From 2018-2022, Saudi Arabia was the world’s second-largest arms importer, buying 78% of its purchases from the U.S., which accounted for 19% of U.S. arms exports.

Increasing domestic manufacturing is intended to build the Saudis’ own industrial base and reduce the risk associated with purchasing arms from other countries, which have a history of tying sales to other issues. For instance, for some time now, Germany has been blocking the sale of roughly 200 Leopard 2A7 tanks to Saudi Arabia, citing human rights concerns and the Saudi-led war in Yemen.

The Saudis also face challenges in acquiring an additional 48 Eurofighter Typhoon combat aircraft. Only when Riyadh approached France regarding the possible purchase of Rafale jets, did Germany reportedly drop its blockade. The Joe Biden administration for two years restricted arms exports to Saudi Arabia until there was a tentative cease-fire in the war with Yemen. Establishing its own arms industry would allow Saudi Arabia to enhance its security in an unstable and unpredictable region.

Riyadh has also been inspired by its neighbor, the United Arab Emirates, which in 2000 established a defense conglomerate called EDGE, which has gained significant market share. In an attempt to replicate the UAE’s success, the Saudis formed SAMI (Saudi Arabian Military Industries) in 2017 and plan to direct up to 50% of government defense spending to domestic facilities by 2030. By then, these facilities are supposed to achieve technological and industrial self-sufficiency. SAMI is projected to become one of the world’s top 25 companies in this sector. According to official data, the level of “Saudization” in the defense industry has already reached 15%.

So far, however, the successes of the Saudi defense industry are modest. Many products displayed at the World Defense Show 2024 and labeled as “Saudi Made” were actually foreign technologies assembled in Saudi Arabia. SAMI presented the HAZEM CMS (Combat Management System), a result of collaboration with the Spanish company Navantia. It is currently being integrated on 104-meter Spanish-made Avante 2200 corvettes, which will join the Saudi fleet. Additionally, the Saudis showcased the ROAYA remotely operated weapon station designed for light vehicles, armored vehicles, and drones.

Saudi Arabia plans to produce aircraft structures, electronic systems, and ground equipment. Final assembly of various systems is also intended to take place on Saudi soil, as well as integration and testing of systems, including sensors. Saudi companies are expected to acquire capabilities in ammunition production and to establish local Maintenance, Repair, and Operations facilities to support equipment used by the Saudi security establishment, including the Saudi Arabian Armed Forces and the Royal Saudi National Guard. Moreover, Riyadh aims to train local engineers, who are an indispensable part of such an ambitious vision. In order to achieve this goal, the General Authority for Military Industries (GAMI) established the National Academy of Military Industries in 2022. It can accommodate up to 2,000 students.

Read more here.